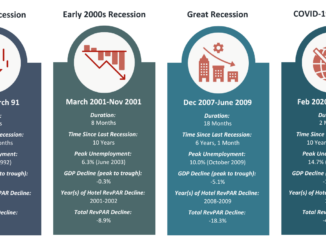

Responding to the announcement from the Bank of England that interest rates have been increased, UKHospitality Chief Executive Kate Nicholls said: “Interest rates reaching their highest levels since 2008 will be a huge worry for hospitality businesses and could significantly impact business viability.

“Hospitality was the business sector most affected by the pandemic, with a large number of businesses forced to take out loans to survive. With those loans now due, consistently rising interest rates compound debt and inflict further economic pain on venues.

“Loan repayment is not the only price pressure businesses face, with the sector now in a period of peak energy pain. Urgent action is needed from Government to bring costs down, particularly on energy, and more needs to be done to assist businesses in their pandemic debt. We would urge HMRC to be lenient in their demands from businesses at this point, allowing Time to Pay arrangements.”

Leave a Reply