BATON ROUGE, La. (BRPROUD) – State lawmakers must decide if they will extend a motion picture tax credit program designed to bring Hollywood’s biggest movie producers to Louisiana.

HB562 was approved by the House earlier this month in a vote of 74-24. But it will only become a law if it is OK’d by the Senate.

If it receives Senate approval, the new law will ensure that every year, $150 million in tax credits will be available to companies that produce films and television shows in Louisiana through 2035.

But legislators can’t agree on whether the motion picture tax credit program has truly benefited the state. Some feel that while a lot of money is handed to producers who film movies and television shows in the state, local tax-paying citizens don’t benefit equally.

Legislators still have a few weeks to make their decision.

State Auditor, Michael J. “Mike” Waguespack has provided them with detailed information to work with. The well-researched brief details how Louisiana’s Motion Picture Investor Tax Credit program has affected the state in previous years.

The brief presents a series of data and statistics meant to help lawmakers decide if the proposed law will benefit Louisiana.

Two key points from the analysis are below. The full document is available here.

Productions that use incentives help the economy but fail to hit the mark in state tax revenue

Over the years, the Louisiana Economic Development has hired researchers to study the Motion Picture Investor Tax Credit Program’s effect on Louisiana’s economy.

The most recent study was conducted by Camoin Associates in October 2022. It found that productions benefiting from the MPITC program eventually provided Louisiana households with an income of $2.50 and 0.23 cents in state taxes for every dollar of credits they received.

The Louisiana Department of Revenue conducted a similar assessment in 2022. The results of its study revealed that the program provided Louisiana households with an income of $1.11 and 0.7 cents in state tax revenue for every dollar the state spent on the program.

The studies appear to confirm that MPITC productions create more household income than it costs Louisiana to fund the incentive program. But the potential downside is that the MPITC fails to create enough tax revenue to cover the cost of the credits.

Most incentivized movies and television shows are filmed in NOLA, which leaves out other areas

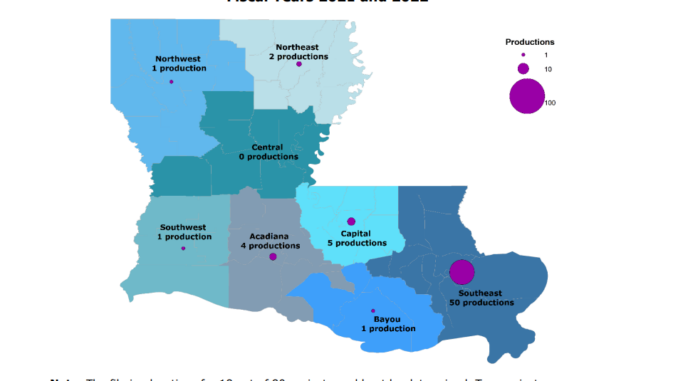

Research revealed that most of the incentivized productions took place in the New Orleans area, while other parishes were left out of the loop. As pictured in the map below, about 78% of motion picture industry productions during fiscal years 2021 and 2022 were filmed in New Orleans. The report indicated that even if this were addressed and productions were spread out more evenly, the population of available Louisiana workers would be small.

The informational explained that if Louisiana’s metropolitan areas outside of NOLA and Baton Rouge become places of interest to television showrunners and filmmakers, there would still be very few locals to support the production. In fact, the report stated that these areas, “would be among the smallest in the country in terms of population to do so.”

Typically, producers are attracted to large cities like Los Angeles or New York City. In recent years, Baton Rouge has become home to more productions than ever before. But the report noted that between 2016 and 2019, compared to other places where a number of productions take place, the capital area still had “the smallest working-age population (563,481 persons).”

New Orleans too, “was the fifth-smallest (812,371 persons) among those with at least 1,500 jobs.”

The comparatively few numbers of able-to-work locals in Louisiana’s metropolitan areas may be another area of concern when it comes to the viability of the motion picture tax incentives.

Leave a Reply