U.S. Performance

As is normal, U.S. hotel occupancy declined given the occurrence of Easter and Passover. These family-oriented holidays typically dampen demand, particularly group demand, as conference planners and attendees opt to stay home. While it may seem logical that weekdays (Sunday-Thursday) would be impacted more than the weekend given the decrease in group activity, the weekend (Friday & Saturday) accounted for most of the demand loss due to the religious observances. More than 80% of the week’s room demand loss occurred on the weekend.

- Occupancy declined 4.9 percentage points (ppts) year over year (YOY) to 61.3%. Last year’s comparable period was a non-Easter week with occupancy of 66.2%.

- When matched to the Easter/Passover week last year (week ending 16 April 2022), occupancy was nearly flat (61.3% vs. 61.9%).

The country’s average daily rate (ADR) of US$153 remained slightly ahead of last year (US$152) and, when combined with occupancy, resulted in revenue per available room (RevPAR) of US$94, down 6.7% YoY due to the holiday shift. As compared to the week of Easter 2022, RevPAR was up 2.2% and was the highest ever recorded for the holiday week but only the eighth best for the holiday week when accounting for inflation.

Top 25 Market occupancy and ADR generally followed the same pattern as the U.S. overall, with occupancy decreasing to 67.7% compared to 72.1% last year and ADR even with last year. When matched to the Easter/Passover week, Top 25 Market occupancy was flat (67.7% vs. 68.0%) and ADR increased 2.8%. A diverse set of large markets achieved higher occupancy this week compared to the matched Easter/Passover week last year. These markets were Boston, Houston, Minneapolis, New York City, Orlando, St. Louis, Tampa, and Washington DC. With the exception of New York and Orlando, these markets had modest-to-weak performance during the first part of last year, which can explain a portion of their more distinguished yearly period gains in 2023.

Occupancy in all other markets dropped 57.9% from 62.5% a week ago. These markets also saw a more significant occupancy decline compared to last Easter/Passover, which is not surprising given their substantial recovery in the prior two years.

Weekday occupancy fell 1.3ppts week over week (WoW), whereas weekend occupancy dropped 13.4ppts WoW. In the Top 25 Markets, weekday occupancy fell to 66.8% from 69.5% a week ago. However, nine of the Top 25 Markets, including Boston, Los Angeles, NYC, and San Francisco saw weekday occupancy that was either flat or up versus last week. New York led the pack with weekday occupancy of 80.3%, up 4.2ppts from a week ago and 6.6ppts higher than a year ago. Weekend occupancy in the Top 25 Markets fell less than the U.S. average, decreasing 10.8ppts WoW to 70%.

While group demand was down, transient demand showed significant strength and exceeded four million rooms sold, which was the highest level since late December. Transient demand was also near the record high set in August 2022. Group demand is expected to rebound to more normal seasonal patterns next week.

Global Performance

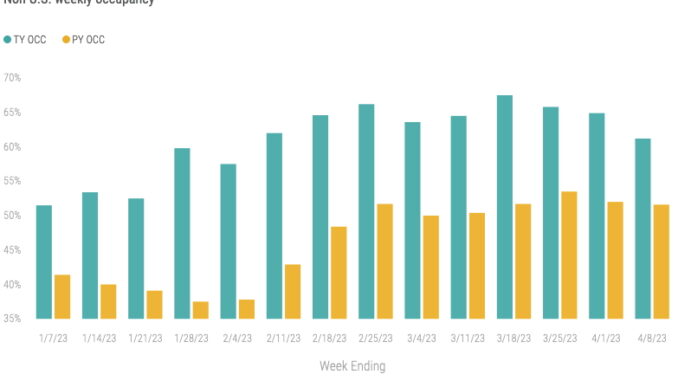

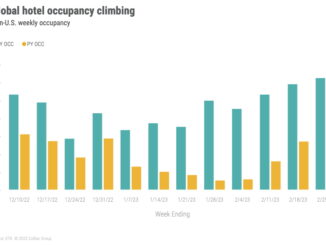

Global occupancy, excluding the U.S., also declined to 61.2%, down 3.7 ppts from last week but 10 ppts ahead of last year. Weekly ADR rose 23.1% YoY to US$144, resulting in RevPAR up almost 50% compared to last year to US$88. RevPAR has grown YoY by 45% or more every week in 2023. In addition, both ADR and RevPAR produced their highest levels of the past 12 weeks.

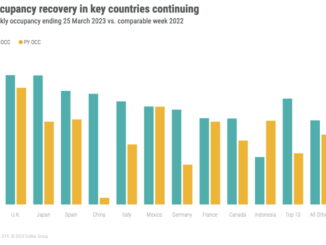

Among the top 10 countries based on supply, occupancy was up on average 5.7 ppts YoY, led by China (+21.5 ppts YoY) and Japan (+18.6 ppts YoY). Mexico, likewise, impacted by the Easter holiday but also coming off its peak Spring Break season, was the only country to see an occupancy decline compared to last year. Globally, weekly occupancy was above 75% in several island countries: the Bahamas, Jamaica, Puerto Rico, and Curacao, along with three northern European countries, the U.K., Netherlands and Ireland.

Final thoughts

Transient/leisure travel was surprisingly strong this past week and almost completely made up for the missing business/conference travel, which experienced an expected falloff for the week. This past week was generally comparable to previous Easter weeks in terms of overall occupancy slowing. ADR remains firmly grounded with positive annual gains although the rate of ADR/RevPAR growth has dramatically slowed since 2022. On a global basis, seasonal shifts along with continued recovery made for solid gains in most countries’ hotel indicators.

Looking ahead

Next week should see respectable growth in U.S. total room demand with continue leisure strength and an increase in business/corporate travel from Tuesday onwards as Monday’s data will still be impacted by Easter Sunday. Additionally, we will have easy comparisons to Easter week 2022. The Top 25 Markets, along with business/corporate-oriented destinations, are expected to see solid weekly growth in demand while most leisure-oriented destinations should expect seasonal shifts in performance. Global performance should continue pacing upward.

This article originally appeared on STR.

Leave a Reply