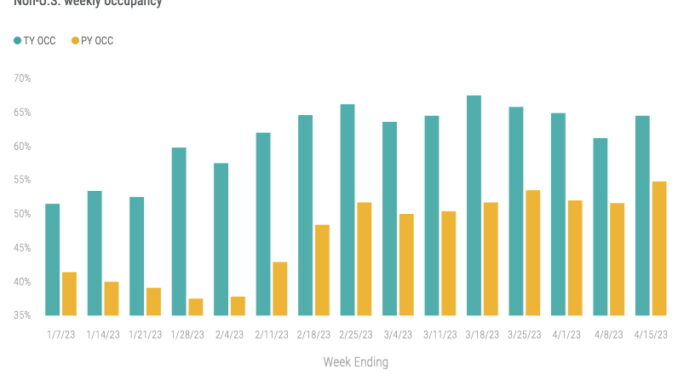

Global occupancy, excluding the U.S., also rebounded to 64.5%, up 3.3 ppts from the previous week and 10ppts ahead of last year. Weekly ADR rose 9.2% YoY to US$137, resulting in RevPAR (US$89) increasing more than 25% from last year.

U.S. Performance

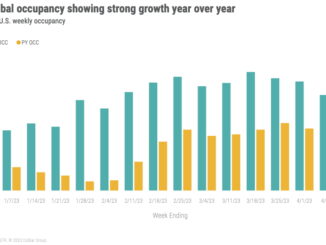

After a typical pre-Easter/Passover slowing, the U.S. hotel industry rebounded with occupancy of 64.2%, which was up 2.8 percentage points (ppts) from the prior week and 2.3 ppts year over year (YoY). For that YoY comparison, keep in mind the matching week a year ago was the one leading up to Easter. When looking at individual days this past week, occupancy increased from Wednesday onwards with Saturday seeing the largest week-on-week (WoW) gain (+15.9ppts). As expected, the sharpest decline was on Easter Sunday with occupancy dropping 10.5ppts WoW.

Average daily rate (ADR) increased 4.7% year over year to US$155. A similar increase was seen when compared to the matched Easter week last year (17-23 April 2022).

Revenue per available room (RevPAR) reached US$100, which was up 8.6% year over year. When compared to the matched Easter week in 2022, RevPAR was not quite as impressive (-2.1%) due to lower occupancy.

With calendar shifts, and as we move further away from pandemic comparisons, the up and down patterns seen over the past weeks is mostly representative of normal seasonal patterns.

Top 25 Market occupancy also rebounded to 69.5%, up 1.8 ppts over the prior week. ADR (US$186) and RevPAR (US$129) in the Top 25 Markets showed continued strength, increasing 2.7% and 5.5%, respectively, over the previous week. Those levels were also up 5.4% and 6.5%, respectively, year over year. Occupancy in all other markets also increased to 61.3%, up 3.4 ppts WoW. ADR (US$137) increased slightly (+0.5%), and RevPAR (US$84) grew significantly (+6.5%) thanks to occupancy gains.

When compared to the matched Easter week in 2022, the Top 25 Markets fared better than all other markets with occupancy down slightly (-1.0 ppts) and ADR and RevPAR up 4.4% and 2.9%, respectively. All other markets were down 2.4 ppts in occupancy, up in ADR (+2.3%) and down in RevPAR (-1.6%).

An examination of each day of the week compared to the matched week in 2022 showed the following:

- For the Top 25 Markets, Tuesday and Wednesday occupancy exceeded 2022, an indication of business travel’s return.

- Easter Sunday and the following Saturday had the greatest downward impact for the week, decreasing almost 3 ppts compared to the holiday week last year although Saturday continued to be the highest occupancy day (80.7% compared to matched week occupancy of 83.3%).

- Occupancy for all other markets softened across all days with the greatest decline on the highest occupancy days, Friday and Saturday (-4.1 ppts and -5.2 ppts, respectively).

These day-of-week changes, both for the Top 25 Markets and all other markets could be attributed to the calendar and the fact that Easter was a week later, as well as evidence that the industry is back to more normal patterns. As summer nears, increased leisure demand along with positive signs for business demand bodes well for the coming months.

The best performing Top 25 Markets for the week represented a diverse set. Chicago, Dallas, Las Vegas, Anaheim, Tampa, and Washington, D.C. all posted higher occupancy this week compared to the matched Easter week last year. Most of the Top 25 Markets also experienced strong year-over-year ADR gains (except Las Vegas with flat ADR) as compared to the matched Easter week in 2022. Orlando and Nashville join this group in terms of ADR gains, but their occupancy levels (73% and 76%, respectively) were lower than the matched week last year.

Group/Transient Performance

Group and transient hotel performance in the luxury/upper upscale segment started to return to more normal levels although some pandemic comparisons linger. This time last year, the industry had passed Omicron and some pent-up group demand materialized.

Other segmentation notes from this past week:

- Group demand rebounded with almost 1.6 million room nights sold, up significantly over the prior week but down 3.9% compared to the matched week in 2022. This decline shows the above-mentioned pent-up group demand last year once Omicron faded.

- Weekly group demand was about 15% below the matched Easter Sunday week in 2019.

- Transient demand, while declining slightly week over week, was 3.4% higher than the matched week in 2022 and essentially even with the week in 2019.

- Group demand in the Top 25 Markets declined from the matched week last year by 4.3%. Markets achieving demand above last year’s matched week level were Chicago, Dallas, Minneapolis, New York, Oahu, and St. Louis.

Global Performance

Global occupancy, excluding the U.S., also rebounded to 64.5%, up 3.3 ppts from the previous week and 10ppts ahead of last year. Weekly ADR rose 9.2% YoY to US$137, resulting in RevPAR (US$89) increasing more than 25% from last year. As we approach the summer travel season, the dramatic growth seen so far this year is expected to moderate as the pandemic moves out of our rearview mirror. Growth is still expected with a now fully global opening of borders but at a less dramatic level.

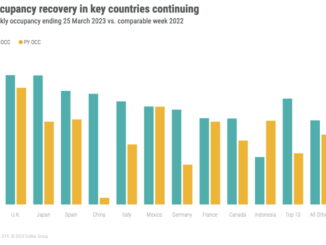

Among the top 10 countries based on supply, occupancy was up on average 14ppts YoY, dominated by China (+32.7ppts YoY) and Japan (+13.8ppts YoY). The interesting pairing of Canada (+6.8ppts) and Indonesia (+6.7ppts) were the next two countries with significant year-over-year growth. Several countries experience year over year declines which are expected given the calendar shifts and as we move toward more normal seasonal patterns across the globe.

Outside the top 10 counties, several island countries had occupancy above 75% over the past two weeks including the Bahamas, Jamaica, Puerto Rico, and Curacao, along with two northern European countries, the Netherlands and Ireland. Fiji also made the list for the most recent week.

Final thoughts

Performance was solid, increasing after the slower pre-Easter/Passover week but still impacted by Easter Sunday and Monday. Group business picked up after Monday, and transient/leisure travel continues to be strong. This past week was generally comparable to the previous post-Easter week, although softer due to strong performance last year impacted by some pent-up demand post-Omicron. ADR remains firmly grounded with positive annual gains although the rate of ADR/RevPAR growth has dramatically slowed from the leisure-driven gains of 2022. On a global basis, seasonal shifts along with continued recovery made for solid gains in most countries’ hotel indicators.

Looking ahead

Next week, group will continue to strengthen as is the pattern this time of year and there is no reason to think transient/leisure will slowing. We should also see some increases in transient/business with mid-week occupancy strengthening. Year-over-year comparisons that don’t exactly align due to the Easter holidays will continue requiring some caveats for at least another week.

Global performance should continue pacing upward albeit at a less dramatic pace than at the start of the year due to the receding impact of the pandemic. Exceptions to this lack of drama are Asian countries, specifically China and Japan, poised to continue with significant year-over-year improvement.

This article originally appeared on STR.

Leave a Reply